Shifting Demand for Multi-Layer Ceramic Capacitors Creates a Critical Supply Shortfall for Industrial and Military Needs

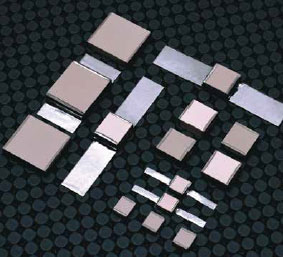

Domestic MLCC manufacturers are ramping up manufacturing capacity to fulfill orders for large format, High Q ceramic capacitors for industrial, medical and military applications.

Industrial, medical, and military demand for high quality, high-voltage multi-layer ceramic capacitors (MLCCs) has been hit hard by a shift in production by the world’s largest MLCC manufacturers who are focusing on a seemingly insatiable demand for smaller, lower voltage – and in some way – lower performance MLCCs. This demand has been fueled by the global growth of 5G networks and continued advancements in smart phones and mobile devices who are consuming significantly more MLCCs per device. As the principal manufacturers pivot away from the larger high voltage, high Q (High Quality) MLCCs used by industry and the military, OEMs are experiencing significant delays in MLCCs of up to six months. The extent of the supply shortage jeopardizes product release schedules, industrial market share, and potentially even military readiness. “It is a pretty massive carrot that is hanging in front of the major MLCC manufacturers,” said Scott Horton, vice president at Johanson Technology, a 40-year provider of high voltage ceramic multi-layer capacitors based in Camarillo, California. “When you consider that a high-end smart phone today can require substantially more MLCCs in a single device as compared to a similar phone only a few years ago, the current demand for smaller, lower power MLCCs is like nothing the market has seen before.”

As a result of a slowdown in consumer demand for capacitors in 2019, many OEMs and distributors were left holding surplus inventory. As a result, these same OEMs and distributors were hesitant to order additional inventory in 2020. Now, as the market ramps up, so does the demand for MLCCs despite very low capacitor inventory. This further exacerbates the shortage of larger high voltage, high Q MLCCs, since some manufacturers have focused production on smaller/lower voltage MLCCs during this time. Now both ends of the market are scrambling to re-stock including the large electronics distributors. It is also largely Asian MLCC manufacturing supporting telecom and mobile device operations which are also based in Asia making fulfillment of industrial MLCC supply needs in Western markets even more acute. “There is a ripple effect to the industrial and military market sector that is not really fully understood,” said Horton. “Although a shortage of electronic products used to manufacture consumer products like smartphones and automobiles would be national news, the lack of supply of larger, higher voltage MLCCs for industrial and military applications are typically under-reported. However, it will continue to squeeze business customers and eventually end users until it is resolved.”

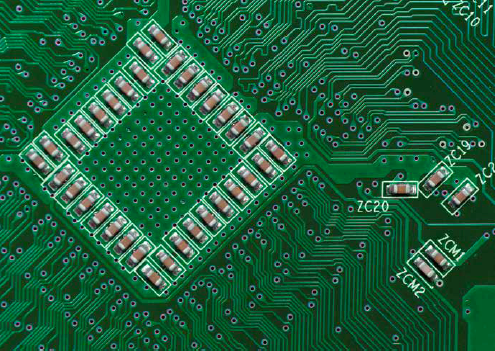

Multi-layer ceramic components MLCCs consist of laminated layers of specially formulated, ceramic dielectric materials interspersed with a metal electrode system. The layered formation is then fired at high temperature to produce a sintered and volumetrically efficient capacitance device. A conductive termination barrier system is integrated on the exposed ends of the chip to complete the connection.

Capacitance is primarily determined by three factors: the k of the ceramic materials, the thickness of the dielectric layers, the overlap area and the number of the electrodes. A capacitor with a given dielectric constant can have more layers and wider spacing between electrodes or fewer layers and closer spacing to achieve the same capacitance.

Industrial, medical and military consumers of MLCCs depend on high voltage and high-Q capacitors for power supplies, amplifiers, MRI coils, plasma generators, lasers and many other specialized applications. In circuits with higher currents, higher-Q MLCCs are preferred to reduce self-heating.

The Q factor represents the efficiency of a capacitor’s rate of energy loss. High Q capacitors lose less energy reducing the need to dissipate or cool the heat which protects the board from damage and performance loss in sensitive and high liability applications. Not all MLCCs are created equal, even among the high performance MLCCs, yet ensuring a consistent level of performance is critical for the high reliability applications required by industrial and military end users.

“If a MLCC manufacturer is not tightly controlling the layer count, they might be providing 10-layer batches in one batch and then later deliver 17-layer parts in a subsequent batch,” explains Horton. “These two parts will not perform the same at high frequencies.”

Domestic supply ramping up

Domestic supply ramping up

Domestic sources of MLCCs needed in industrial and military applications have been ramping up their capacity. Increased domestic MLCC supply means an industrial or military customer will not need to delay the build and shipments of their products because of a capacitor delay.

Drawing upon its focus on high-Q and high voltage MLCCs, Johanson, for example, has expanded its capacity to fill some of the supply void caused by the shift in market focus to smaller capacitors. “We’ve been investing in expanding our capacity for several years now through a modernization of our production facility and the opening of a second production line that will essentially double our MLCC output,” says Horton. “We can take that even higher with more production shifts.” At the time of the preparation of this article, Johanson is quoting large size high voltage MLCC order fulfillment times at 10 weeks.

Ceramic is the material of choice

Increasing domestic high voltage MLCC supply also means that customers do not need to look beyond ceramic capacitors to satisfy their demand. As a result of the long lead times, replacing a MLCC with a polymer or tantalum capacitor may be considered; however, trade-offs in performance and optimal operating conditions need to be carefully considered. Polymers in capacitors can be degraded by the effects of heat which is a consideration for some applications. The thinness of the dielectric layer in polymer capacitors means the maximum voltage is lower than in ceramic capacitors making it inappropriate for high voltage products.

Polymers are also not available in the low values of capacitance that ceramics provide. A tantalum electrolytic capacitor consists of a pellet of porous tantalum metal as an anode covered by an insulating oxide layer that forms the dielectric surrounded by a liquid or solid electrolyte as a cathode. While regarded as a reliable and a suitable alternative to MLCCs, tantalum capacitors are generally polarized which means they may only be connected to a DC supply. An unfavorable failure mode may lead to thermal runaway and fires. Tantalum capacitors are also currently experiencing extended sourcing lead times.

“There’s just no reason to move away from ceramic for your high-voltage, high quality applications,” said Johanson’s Horton. “There is now a growing domestic MLCC supply available to meet our domestic needs.”

Shifts in supply and demand within the overall MLCC market, which is estimated to grow to a $12 billion market by 2025, have caused critical supply shortages for industrial, medical and military customers who require a higher quality, larger format multi-layer ceramic capacitor. As the largest MLCC manufacturers continue to compete for the demand of the MLCCs used by sectors like telecom, smart phones and mobile devices, new domestic supply sources are stepping in to meet the need for a reliable and timely supply of high performance MLCCs.